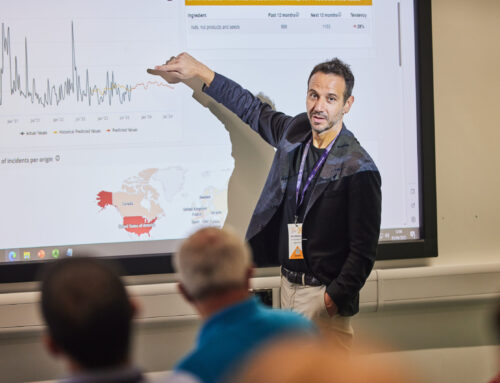

The recent Global Crisis Management Summit Americas (GCMS’24) illuminated a fascinating nexus – the convergence of artificial intelligence (AI), food safety, and insurance dynamics. Amidst the diverse array of discussions and dialogues, one prevailing theme emerged; the expectation among some companies that their insurance providers should foot the bill for digital risk intelligence platforms like FOODAKAI.

Consider this scenario: a major non-alcoholic beverage manufacturer and bottler decides to invest in an annual subscription to FOODAKAI, with the anticipation that their insurance company would cover the costs. This curious expectation piqued my interest and prompted reflection on the underlying motivations driving such an assumption.

Why are they expecting their insurance company to pay the bill?

Fast forward to GCMS’24, a gathering bustling with stakeholders deeply entrenched in the recall market – an intricate landscape where product recalls reverberate with financial repercussions and reputational risks. But what exactly constitutes this enigmatic “recall market”?

Investopedia defines it as the labyrinth of processes involved in retrieving and replacing defective goods, fraught with financial liabilities and consumer trust at stake.

“A product recall is the process of retrieving and replacing defective goods. The company or manufacturer absorbs the cost of replacing and fixing defective products, or of reimbursing affected consumers.”

At its core lies the symbiotic relationship between food manufacturers and their insurers. Product recall insurance emerges as a critical safeguard, shielding manufacturers from the financial fallout of recall events. From shipping and warehouse costs to disposal and restocking expenses, the spectrum of recall-related expenditures underscores the pivotal role of insurance in mitigating financial strain.

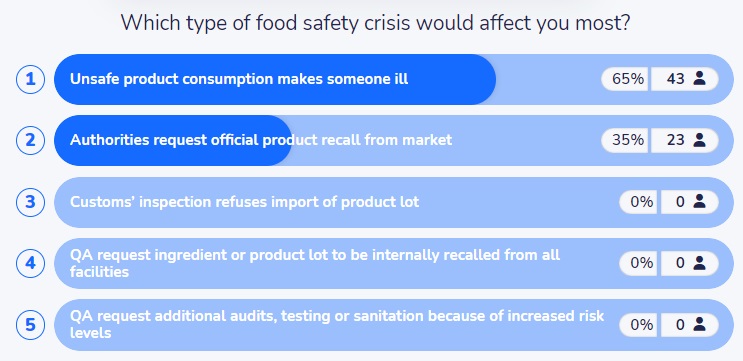

What does the GCMS audience consider a crisis?

The crux of the matter lies in risk assessment – a terrain meticulously navigated by insurance underwriters tasked with deciphering the probability and magnitude of potential risks. They are professionals who evaluate and analyze the risks involved in insuring people and assets, using specialized software and actuarial data to determine the likelihood and magnitude of a risk. As a matter of fact, this is how they decide about insurance prices (i.e. insurance premiums).

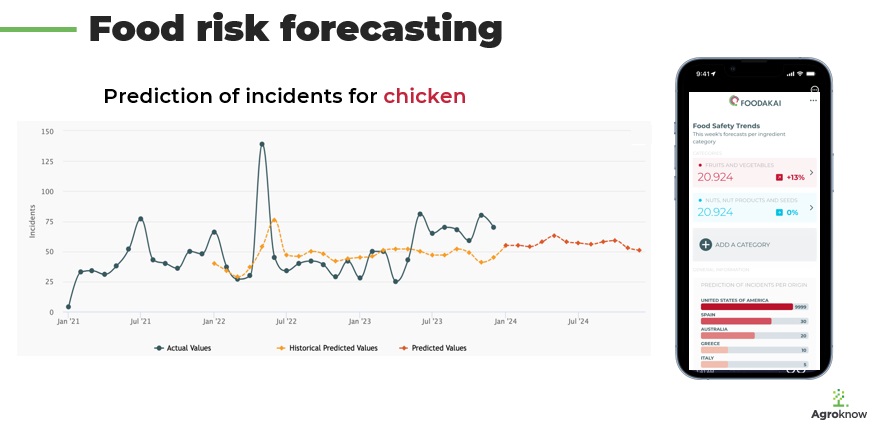

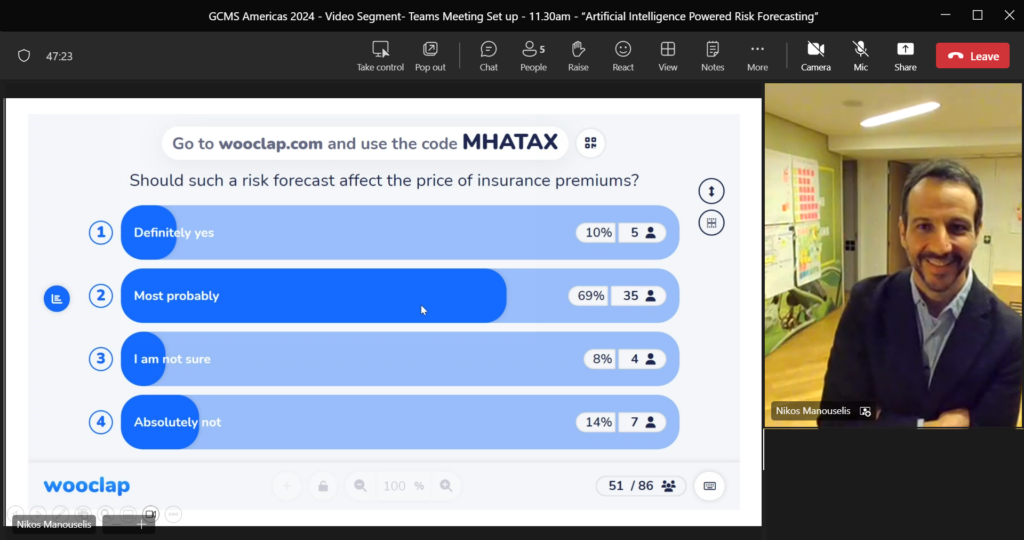

Enter AI-powered risk forecasting models, poised to revolutionize traditional horizon scanning methodologies and equip industry professionals with unprecedented insights into emerging trends and latent risks.

Risk forecasting at our fingertips

However, lingering skepticism looms large. The prospect of entrusting crucial insurance decisions to algorithmic predictions remains a subject of debate, punctuated by apprehensions regarding AI’s efficacy in delivering actionable insights. The discourse at GCMS’24 unveiled a nuanced landscape, where food safety risk forecasting assumes newfound relevance across diverse spectrums. Yet, amidst the palpable enthusiasm surrounding AI’s disruptive potential, reservations persist, echoing Munich Re’s cautionary sentiments regarding the symbiosis of human experience and technological innovation in insurance underwriting practices.

Should my insurance pay?

As the curtains draw on GCMS’24, lingering questions persist, beckoning further exploration into the intricacies of food safety risk forecasting and the evolving dynamics of insurance underwriting. The journey towards harnessing AI’s transformative prowess remains rife with uncertainties, yet brimming with untold possibilities.

In the corridors of innovation and risk management, one thing remains abundantly clear:

The quest for foresight amidst uncertainty is a journey shared by all.

It is transcending boundaries and beckoning us towards a future illuminated by the promise of AI-powered innovation.